Welcome to Mabstac, LLC | Anything Accounting

- Call us: (703) 828-2336

- Mail US : info@mabstac.com

- ADD US : Mabstac, LLC

- Call us: (703) 828-2336

- Mail US : info@mabstac.com

- ADD US : Mabstac, LLC

Issued by the Governmental Accounting Standards Board, GASB 96 defines Subscription-Based Information Technology Arrangements (SBITAs) and provides guidance on accounting and financial reporting for government entities. The statement was created to regulate the accounting and disclosure around subscription-based payments for cloud-based software agreements.

What is GASB 96?

In May of 2020, the Governmental Accounting Standards Board, or GASB, finalized how SBITAs are recorded on financial statements through the issuance of GASB Statement No. 96.

GASB 96 requires all covered organizations or governmental entities to record a right-to-use subscription intangible asset and corresponding subscription liability. The standard also provides guidance in accounting for cash outlays such as implementation fees, related to SBITA’s to prevent future disparities in how government entities report on non-subscription costs.

When is GASB 96 effective?

While GASB highly encourages early application of this new standard, GASB 96 is effective for organizations with fiscal years beginning after June 15, 2022.

Who does GASB 96 apply to?

GASB 96 applies to all public sector entities that follow Generally Accepted Accounting Principles (GAAP) in filing their annual financial statements, including state and local governments, school districts and public higher ed institutions.

What is a SBITA under GASB 96?

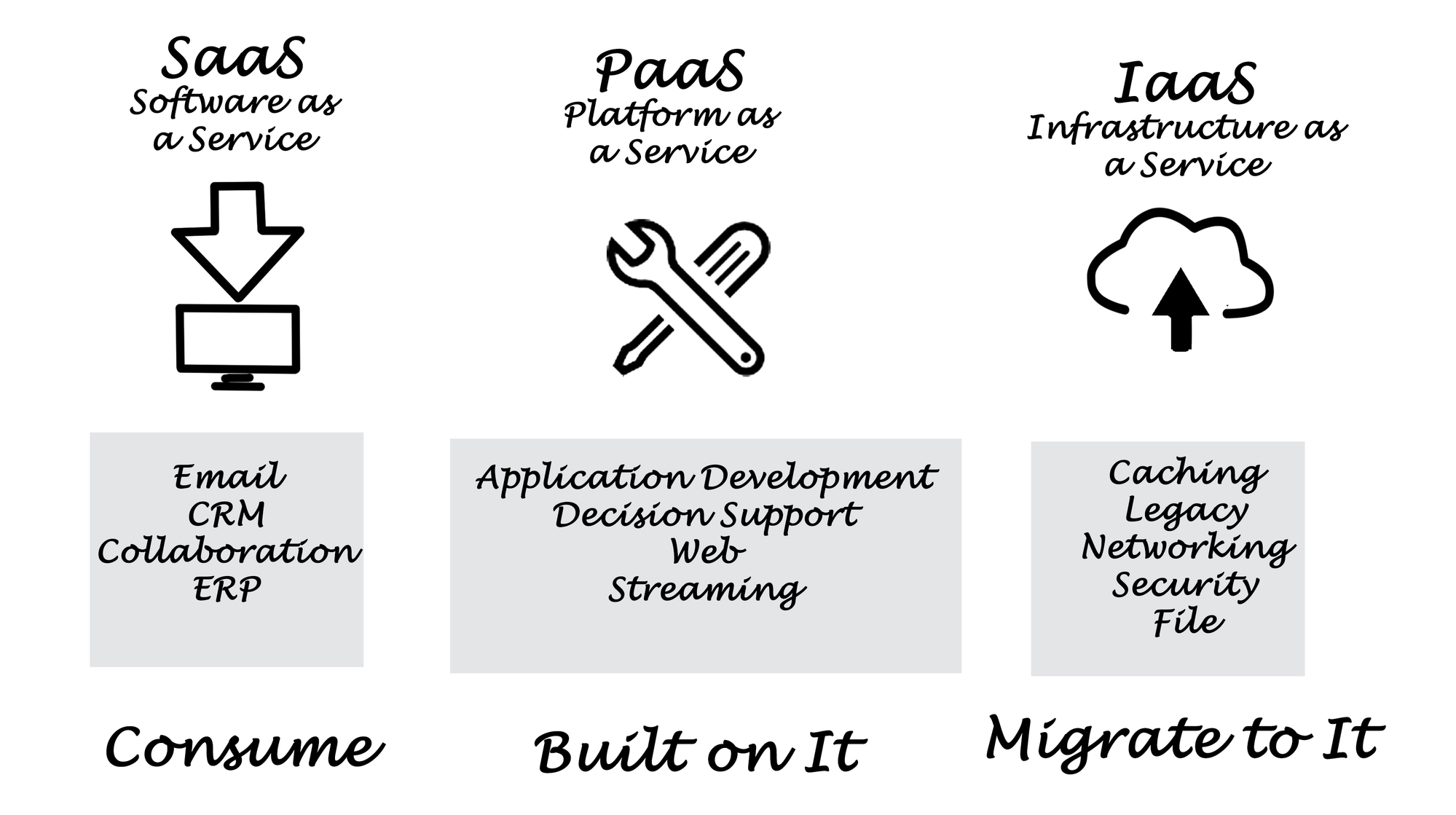

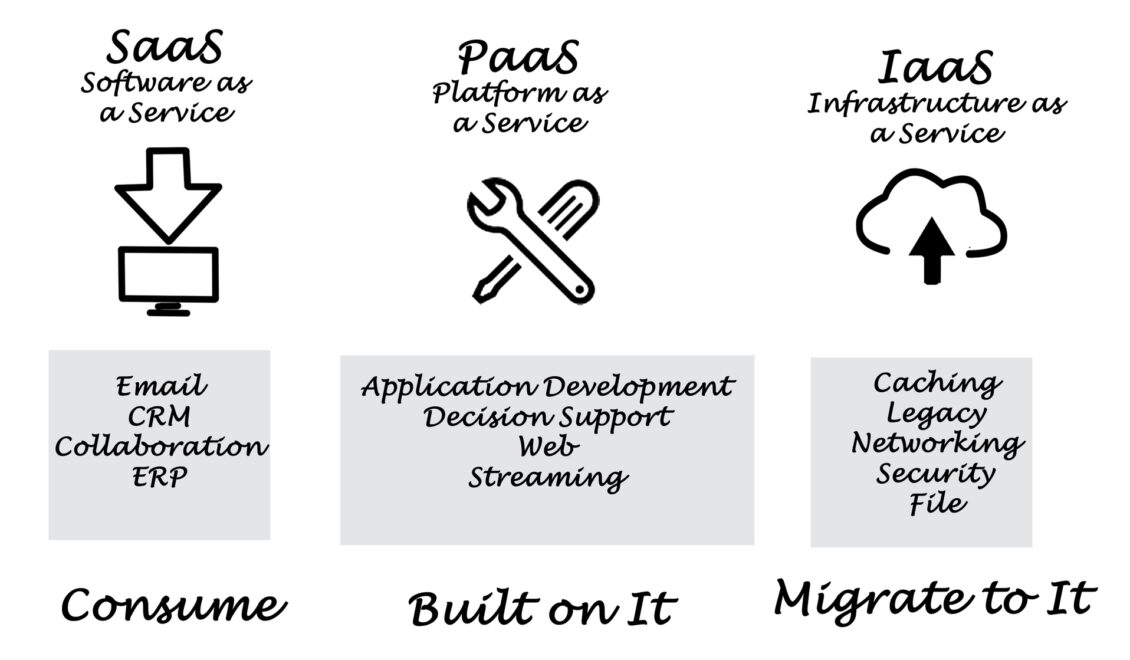

Under GASB 96, a SBITA is a contract that conveys control of the right to use another party’s (a SBITA vendor’s) IT software, alone or in combination with tangible capital assets (the underlying IT assets), as specified in the contract for a period of time in an exchange or exchange-like transaction.

For GASB 96 to be directly applicable, the organization must first determine that the contract is a SBITA. A crucial component in defining the subscription terms is the element of control over the underlying IT assets. An assessment must be made, and specific stipulations are required in understanding what rights your organization has regarding the present service capacity. Once this distinction is made, excluding certain exemptions, the subscription term is the noncancellable period of time that the government has the right to use the underlying IT asset.

What contracts are exempt under GASB 96?

GASB 96 excludes contracts that only provide IT support services, but includes contracts providing IT support services in conjunction with the right to use a related IT asset. The following are also exempt from the scope of GASB 96:

- Standalone IT services contracts that do not include the right to use an underlying IT asset

- Agreements providing outside entities the right to use their own IT software and associated assets through an SBITA

- Contracts that meet the definition of a lease under GASB 87, Leases

- Contracts that fall under the scope of GASB 94, Public-Private and Public-Public Partnerships and availability Payment Arrangements

- Contracts that fall under the scope of GASB 51, Accounting and Financial Reporting for Intangible Assets

- Short-term SBITA contracts

What are short-term SBITAs?

GASB 96 provides exemptions for short-term SBITAs. Under GASB 96, a short-term SBITA has a maximum possible term of 12 months at the commencement of the subscription term. This includes any renewal or extension options regardless of whether the government is reasonably certain to exercise these options. The governmental entity is not required to recognize a subscription asset and liability for any short-term SBITA.

How do I recognize and measure an SBITA?

If an SBITA is identified, government entities recognize a subscription liability and a subscription asset at the beginning of the subscription term of the SBITA, which occurs when the government entity obtains control of the right to use the underlying IT asset.

The subscription term is the period that the government has the noncancellable right to use the underlying IT assets, plus the following periods, if applicable:

- Periods covered by a government’s extension option if it is reasonably certain that the government will exercise that option

- Periods covered by a government’s termination option if it is reasonably certain that the government will not exercise that option

- Periods covered by a vendor’s extension option if it is reasonably certain that the SBITA vendor will exercise that option

- Periods covered by a vendor’s termination option if it is reasonably certain that the vendor will not exercise that option

What is a subscription asset?

In addition to the subscription liability, the government must recognize a subscription under GASB 96. The subscription asset is measured as the initial value of the subscription liability plus:

- Payments made to the vendor at the commencement of the subscription term

- Capitalizable initial implementation costs

- Minus any vendor incentives received at the commencement of the subscription term

The government entity will need to amortize the subscription asset systematically and rationally over the shorter of the subscription term or the useful life of the underlying IT asset. Amortization of the subscription asset begins at the commencement of the subscription term and is reported as an outflow of resources by the governmental entity.

What is a subscription liability?

The initial subscription liability is measured as the present value of the total subscription payments expected to be made to the vendor during the subscription term. The total future payments are discounted using the interest rate the vendor charges the government, which may be the interest rate implicit in the SBITA. If the implicit interest rate is not readily determinable, the government may use an estimated incremental borrowing rate for the present value calculation.

GASB 96 outlines that the payments included in the present value calculation of the subscription liability should include the following:

- Fixed payments

- Variable payments based on an index or a rate, measured using the index or rate as of the commencement of the subscription term

- Variable payments that are fixed in substance

- Termination penalties, if the subscription term reflects the government exercising either an option to terminate the agreement or a fiscal funding or cancellation clause

- Incentives receivable from the vendor

- Other payments the government is reasonably certain will be required to be made to the vendor

In subsequent periods, the government will accrue interest on the remaining subscription liability at the applicable discount rate. The subscription payments will be allocated first to the accrued interest, and then to reduce the outstanding subscription liability.

What are the outlays under GASB 96?

There may be cash outlays for other activities associated with SBITAs under GASB 96. The type and timing of the activity dictates the accounting treatment of these cash outlays; other activities associated with SBITAs are grouped into three stages:

1.Preliminary project stage

The preliminary project stage includes costs associated with activities such as evaluating alternatives, determining needed technology, and selecting an SBITA vendor. Outlays in this stage should be expensed as incurred.

2.Initial implementation stage

The initial implementation stage includes all ancillary charges necessary to place the subscription asset into service. Outlays in this stage generally should be capitalized as an addition to the subscription asset.

3.Operation and additional implementation stage

The operation and additional implementation stage, includes activities such as subsequent implementation activities, maintenance, and other activities for ongoing operations related to a SBITA. Outlays in this stage should be expensed as incurred unless they meet specific capitalization criteria.

What are the disclosure requirements under GASB 96?

A government entity should disclose the following information about its SBITAs (which may be grouped for purposes of disclosure) in notes to financial statements:

- A general description of its SBITAs, including the basis, terms, and conditions on which variable payments not included in the measurement of the subscription liability are determined

- The total amount of subscription assets, and the related accumulated amortization, disclosed separately from other capital assets

- The amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the subscription liability

- The amount of outflows of resources recognized in the reporting period for other payments, such as termination penalties, not previously included in the measurement of the subscription liability

- Principal and interest requirements to maturity, presented separately, for the subscription liability for each of the five subsequent fiscal years and in five-year increments thereafter

- Commitments under SBITAs before the commencement of the subscription term

- The components of any loss associated with an impairment

Get ready for GASB 96

Meeting the compliance standards for GASB 96 requires consistency, accuracy and the collection of your portfolio data — specifically information surrounding SBITAs. At the same time, evaluating accounting software solutions will allow you to implement a solution that will allow you to meet the standards outlined in GASB 96.